7.5.3.1

Medical, Dental, Vision, Telemedicine & Life Insurance

Shasta Head Start offers its regular, full-time employees an extensive benefit package. All employee-only coverage for medical, dental, and vision is entirely paid for by Shasta Head Start. Dependent coverage is available for a reasonable fee and paid for by the employee. For benefit related questions, contact the HR Dept. and/or refer to SOP 7.5.3.1.3 BAT.

Medical

Shasta Head Start is self-insured with the help of EBMS as a third-party administrator. The SHS Medical 3000 plan operates under a reference-based pricing plan model and is not restricted to a network. This plan is a high-deductible health plan with a $3,000 annual (calendar year) deductible. This plan is a Health Savings Account (HSA) compatible plan.

By not being restricted to a network employees can compare pricing and quality of services between providers and decide who they would like to partner with for their health.

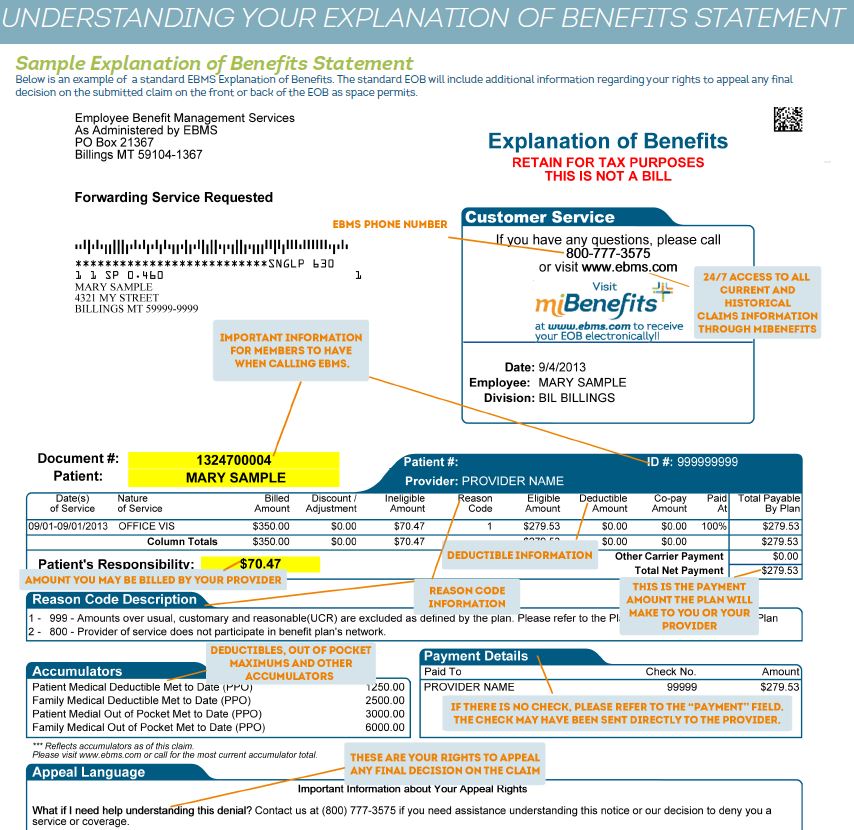

Services should never be paid for in advance or at time of service; providers should always bill insurance first. If providers have questions or assistance is needed, they can call EBMS using the number on the back of the employee’s medical ID card. After services are performed, an explanation of benefits (EOB) will be mailed by EBMS explaining what is covered by insurance and what is owed to the provider. The provider will send a bill separately. If the bill from the provider does not match the EOB, the issue needs to be addressed immediately.

Below is a sample of what an EOB looks like:

To assist with the evaluation of all claims to ensure healthcare costs are paid at a fair price, Shasta Head Start partners with ELAP Services.

After receiving care from a provider or facility, ELAP will audit the bill to identify any overcharging. The third-party administrator, EBMS, will pay the adjusted amount to the provider or facility. Most of the time, the provider or facility accepts payment; if not, the provider can appeal to the plan or “balance bill” the member. A balance bill is a bill from the provider for anything above what is shown on the EOB.

If a balance bill is received, notify the Benefits Advocacy Team (BAT) immediately. It is important to compare every bill from the provider or facility to the explanation of benefits (EOB) from EBMS. If any bills do not match the EOB, contact BAT for assistance.

In the case of a balance bill, ELAP should be contacted immediately. The employee will sign forms giving ELAP permission to advocate on an employee’s behalf. ELAP will assign a dedicated Member Services Advocate to an employee’s case. The advocate will serve as a primary contact regarding the resolution of the balance bill. An expert legal representative will work on the employee’s behalf (at no cost) to resolve the balance bill.

Please refer to the benefit guide for more details.

Telemedicine

The IRS is currently allowing telemedicine for HSA-eligible medical plans. Shasta Head Start capitalized on this opportunity and is pleased to be able to offer telemedicine through First Stop Health. This benefit is also available to eligible employee’s immediate family members at no cost. Eligible employees and/or their family members can talk with board-certified doctors 24/7 via mobile app, website, or phone to deal with a wide variety of non-life-threatening conditions. If applicable, prescriptions are sent to a nearby pharmacy and doctor’s notes are accessible via app, website, or email.

Note: if a prescription is necessary, the cost will not be covered by First Stop Health. Prescriptions can be charged to insurance and the remaining balance (if any) will be paid by the employee.

Additionally, virtual mental health services are available through First Stop Health. Mental health services are available 24/7 for patients to access short-term, solution-focused counseling. Licensed counselors are available nationwide via phone or video to help with mental health issues such as stress, depression, anxiety, grief, marital/work/family issues, alcohol/drug dependencies, etc.

Health Savings Account (HSA)

The HSA Authority health savings accounts (HSA) accompany the SHS Medical 3000 plan. In order to participate, employees must be enrolled in the SHS Medical 3000 plan. Employees can contribute pre-tax (federal tax) dollars to their HSA up to $4,150 per year for individual or $8,300 for family. The annual “catch-up” contribution amount for employees aged 55 or older is $1,000. Monies from an HSA can be used to pay for qualified medical expenses. There is no fee for active employees to have an HSA.

An HSA is owned by the individual employee and can be carried over from year to year. Because each employee owns their HSA, it is yours even if you retire or leave the employ of Shasta Head Start. For further instruction on how to open an account, refer to SOP 7.5.3.1.2 HSA Enrollment.

Please refer to the benefit guide for more details, including important eligibility information.

Dental

SunLife Dental PPO plan offers a $2,000 in-network ($1,500 out of network) benefit each calendar year for employees with a $50 annual deductible. Although there are PPO provider lists available and the benefits are enhanced if used within the network, employees may elect to see the dentist of their choice without penalty. Using the PPO providers maximizes benefits and reduces out-of-pocket costs.

Sun Life also offers an online portal with access to your Dental Card, Benefit Tools, and other online services. For more information on available resources and how to register, please refer to our Dental Plan Tips resource.

Please refer to the benefit guide for more details.

Vision

With the VSP Vision plan, employees have access to receive discounted services from an extensive network of vision care providers nationwide. Glasses, contact lenses, and routine eye exams are some of the benefits offered through the VSP Vision plan.

Please refer to the benefit guide for more details, including allowances and frequency information.

Life and AD&D

Life insurance and Accidental Death & Dismemberment (AD&D) insurance provide funds for those who have lost someone or for those who are seriously injured. Life insurance pays funds to designated beneficiaries after death, while AD&D pays an amount equal to life insurance in the event of an accidental death. In the event of a loss of limb, eyesight, hearing or other covered loss, a predetermined amount will be payable. These insurances are provided at no cost.

Please refer to the benefit guide for more details, including portability and age reduction information.

RESOURCES:

2022-2023 Benefit Informational Video – SolV Insurance

2023-2024 Open Enrollment Meeting

Explanation of Benefits (EOB) Example

Machine-Readable Files (Posted in Compliance with Transparency in Coverage Final Rule)